Comparison Between LLP and Private Limited Compliance

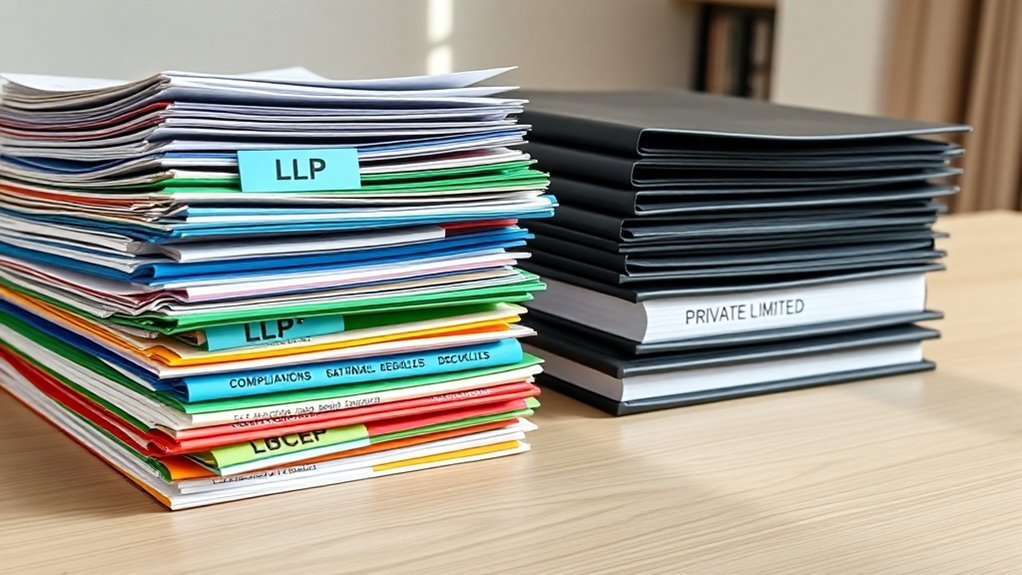

When comparing Limited Liability Partnerships (LLPs) and Private Limited Companies in the context of Indian laws and regulations, there are notable differences in compliance requirements. LLPs in India are subject to fewer statutory filings and are not mandated to hold annual meetings, which can simplify their operational procedures. In contrast, Private Limited Companies must adhere to stringent compliance norms, such as maintaining comprehensive financial records, undergoing mandatory audits, and filing annual returns with the Registrar of Companies.

Additionally, the governance structures of these two types of entities differ significantly. LLPs promote equal decision-making among partners, allowing for a more collaborative approach in management. On the other hand, Private Limited Companies operate under a hierarchical board structure, where decisions are made by directors and shareholders.

For a more thorough understanding of their distinct characteristics and compliance frameworks, exploring these topics further can provide valuable insights.

Key Takeaways

- Limited Liability Partnerships (LLPs) in India have fewer compliance obligations compared to private limited companies, which allows for greater operational flexibility.

- Private limited companies are mandated to file annual returns and maintain proper financial records in accordance with the Companies Act.

- Unlike private limited companies, LLPs are not required to hold annual meetings, giving them more flexibility in governance structures.

- Private limited companies must undergo annual audits conducted by a qualified Chartered Accountant, whereas LLPs do not have this requirement.

- While LLPs need to ensure accurate filings with the Registrar of Companies (ROC), private limited companies face more stringent regulatory compliance and accountability measures.

Understanding Limited Liability Partnerships (LLPs)

Limited Liability Partnerships (LLPs) in India offer a unique blend of flexibility commonly associated with partnerships and the liability protection characteristic of corporations. Under the Indian regulatory framework, LLPs ensure that partners enjoy limited personal liability for the business’s debts and obligations, effectively safeguarding personal assets from any business-related risks.

This structure facilitates collaborative management among partners without the stringent requirements typically imposed on corporate entities.

Moreover, LLPs in India aren’t mandated to conduct annual meetings or maintain extensive documentation, which provides greater operational freedom.

However, it’s essential for LLPs to adhere to specific compliance requirements, including the filing of incorporation documents and registration with the Ministry of Corporate Affairs.

Partners must also select a suitable name for the LLP and clearly outline each partner’s roles and responsibilities, ensuring that all members understand their obligations while benefiting from the shared ownership model.

Additionally, the process of drafting an LLP agreement is crucial in defining the relationship and responsibilities between partners, thereby enhancing the partnership’s structure.

This legal structure is particularly appealing for professionals and small businesses seeking a combination of flexibility and limited liability.

Overview of Private Limited Companies

When structuring a business in India, private limited companies (Pvt Ltd) are recognized for their unique advantages, merging limited liability protections with a solid governance framework. This business model safeguards owners from personal liability, ensuring their assets remain safe from the company’s debts.

Here are four essential features to understand:

- Limited Liability: As a shareholder, your responsibility for the company’s debts is confined to your investment in the company, thereby shielding personal assets from business liabilities.

- Separate Legal Entity: A private limited company is considered a distinct legal entity, separate from its shareholders. This means that the company’s obligations and liabilities don’t extend to the personal assets of the owners.

- Ownership Restrictions: Shares in a private limited company can’t be publicly traded, which enhances stability and minimizes the risk of hostile takeovers, as ownership is typically limited to a select group of individuals.

- Regulatory Compliance: Operating under Indian laws, private limited companies must adhere to specific regulatory requirements that enhance transparency and accountability, including maintaining proper financial records and filing annual returns with the Ministry of Corporate Affairs.

Additionally, the process of registering a private limited company involves understanding the relevant government fees and documentation requirements, which can significantly influence the overall time and cost of registration.

This structure is particularly advantageous for entrepreneurs seeking to establish a stable and secure business environment while retaining control over their company.

Statutory Filings and Documentation Requirements

While establishing and managing a private limited company in India presents various advantages, it also involves adhering to a stringent set of statutory filing and documentation requirements outlined by Indian laws and regulations.

Key obligations include the preparation and filing of annual returns and financial statements with the Registrar of Companies (RoC). It’s critical to maintain accurate minutes of board meetings and shareholder meetings, as these records are essential for compliance purposes.

Various forms must also be filed promptly to reflect changes such as directorship updates or alterations to the registered office address.

Moreover, strict adherence to the provisions of the Companies Act is mandatory, which imposes specific deadlines for compliance. Ensuring that all documentation is organized and submitted accurately is vital to avoid facing penalties and complications in the future. Additionally, understanding the significance of ROC filing for LLPs is important for accurate compliance for other business structures.

Audit Obligations and Financial Statements

Understanding audit obligations and financial statements is crucial for private limited companies in India, as non-compliance can lead to serious ramifications.

It’s imperative for private limited companies to ensure that their financials are accurately represented and audited on an annual basis. Here are some important audit obligations to consider:

- Mandatory Audit: All private limited companies are required to have their accounts audited by a qualified Chartered Accountant.

- Financial Statements: Companies must prepare essential financial documents, including balance sheets, profit and loss accounts, and cash flow statements.

- Filing with Registrar: It’s a requirement to file audited financial statements with the Registrar of Companies each year.

- Adherence to Standards: Ensuring compliance with Indian Accounting Standards is crucial for accurately portraying the company’s financial position.

Moreover, understanding the differences between different types of audits can help organizations maintain organizational integrity and accountability. Overlooking these obligations can have significant consequences for your business.

Governance Structures and Management Differences

Governance structures and management differences between Limited Liability Partnerships (LLPs) and private limited companies in India play a significant role in how these entities operate under Indian laws and regulations.

In an LLP, partners have an equal say in decision-making and manage the business collaboratively, allowing for a more flexible structure that’s ideal for those who value shared responsibility. Conversely, a private limited company follows a more hierarchical structure, typically led by a board of directors responsible for making key decisions. While this can offer clarity and efficiency in management, it may sometimes feel less inclusive to the stakeholders involved.

Compliance requirements also vary between the two entity types, with private limited companies subject to stricter regulations outlined in the Companies Act, 2013. These regulations impose a range of obligations regarding financial reporting, governance, and corporate transparency.

On the other hand, LLPs are governed by the Limited Liability Partnership Act, 2008, which provides certain leniencies compared to the complexities of corporate regulations. A key difference is that LLPs offer limited liability protection, making them attractive for professionals seeking to mitigate risks while enjoying operational flexibility.

Understanding these distinctions in governance structures can help you choose the appropriate entity type that aligns with your business goals and management style in the context of Indian laws and regulations.

Questions

Can LLPS Have More Than Two Partners?

Yes, LLPs (Limited Liability Partnerships) under Indian laws can have more than two partners. In fact, there is no upper limit on the number of partners in an LLP as per the Limited Liability Partnership Act, 2008. This provision allows for greater flexibility in managing the partnership, as well as in sharing responsibilities and profits among the partners.

What Is the Process to Convert a Private Limited Company to an LLP?

To convert a private limited company to a Limited Liability Partnership (LLP) in India, you must follow a defined process. First, ensure that you pass a special resolution approving the conversion as per the Companies Act. Next, file the necessary forms with the Registrar of Companies (ROC), which include the application for conversion and any pertinent declarations. Once the application is processed, you will receive a Certificate of Incorporation for the LLP. Finally, adhere to the compliance steps outlined in the LLP Act, which may involve updating your business records and notifying stakeholders of the conversion.

Are LLPS Taxed Differently Than Private Limited Companies?

Yes, LLPs and private limited companies are taxed differently under Indian laws. While LLPs benefit from pass-through taxation, meaning that the income is taxed at the partner level rather than at the entity level, private limited companies are subject to corporate tax rates. This distinction significantly influences overall liability, income distribution, and financial planning strategies for businesses operating within India.

Can Foreign Nationals Be Partners in an LLP?

Yes, foreign nationals can be partners in a Limited Liability Partnership (LLP) in India. They must comply with the regulatory requirements stipulated by the Indian government. This includes obtaining the necessary approvals and registrations as per the Foreign Exchange Management Act (FEMA) and adhering to any guidelines issued by the Ministry of Corporate Affairs. Therefore, it is essential for foreign nationals interested in becoming partners in an LLP in India to familiarize themselves with these legal stipulations.

What Happens if an Llp’s Partner Withdraws?

If a partner withdraws from a Limited Liability Partnership (LLP) in India, the provisions outlined in the LLP agreement must be followed. Generally, the remaining partners can continue the business operations, but the departing partner’s interest must be settled in accordance with the terms agreed upon within the LLP agreement. It is important for the remaining partners to ensure compliance with the relevant provisions of the Limited Liability Partnership Act, 2008, to avoid potential legal complications.